When undertaking any form of workforce planning, a key first step as part of the Baselining stage is to conduct a workforce segmentation exercise. The aim of workforce segmentation is to divide the workforce into groups in order to:

- Better understand the workforce, and

- Determine Roles of Interest

Better Understand the Workforce

From the outside, a workforce looks simply like a collection of heads and, indeed, headcount/budget planning often doesn’t go beyond this notion in understanding both the cost of a workforce and the cost/benefit of headcount changes (headcount x average salary = cost). It is simply the origin of segmentation and headcount and FTE (full-time equivalent) remain key metrics in understanding the workforce. By segmenting the workforce based on different dimensions, you start to see how different parts of the organisation contrast in their makeup and therefore need different approaches based on the strategic ambition of an organisation.

The key dimensions for the workforce are:

Structures. Operational and financial structures are the most common approach to workforce segmentation. The financial structures arrange workers based on business-specific financial management and accountabilities; they are typically referred to as Profit (for revenue generating areas) or Cost centres (for functional areas). Operational structures will be derived from the basis of the organisational design, which may include a mixture of product lines, geographies and functions; these should flow all the way from the organisation or group level, right down to the team level.

Demography. The main categories that fall under demography are what is commonly referred to as ‘diversity data’, the main ones being considered protected characteristics in the UK under the Equality Act 2010, and includes age, gender, ethnicity and disability. The additional aspect to demography is the geographic distribution (both in terms of office locations and worker locations).

Contract. This is specific elements of contractual relationship with the organisation: are they a permanent worker or a contractor, are there different full-time rates (eg 37hrs vs 40hrs), what is the mix of full-time and part-time1 workers, are there any TUPE transfers or secondees?

Tenure. This refers to employment start date, time in role, time at pay grade, etc

Competency. Those organisations with an effective Job Family mapping will have a robust framework for competency dimensions. In the absence of job families, then it can be helpful to capture the following competency dimensions:

- Hierarchy – the level of a person within a Hierarchy, this may be captured with titles (eg Manager), levels (eg CEO minus 4) or pay grades (eg £40-50k)

- Sector Experience – experience within particular industry sectors

- Qualification – attainment of a specific level within an educational framework

- Certification – attainment of a validated standard that is bound by time

- Education and Training – participation in learning isverigeapotek.com

- HiPo and Talent Groups – membership of a particular groups that are either recognised as having High Potential for a particular Competency or otherwise grouped together, and supported, to progress to attainment of a particular Competency

- Skill – a proficiency in a particular field

- Appetite – a desire for proficiency in a particular field or experience within and industry sector

Some useful metrics for initial segmentation are:

- Headcount and FTE

- Salary

- Sickness levels

- Turnover rate

- Promotion rates and internal mobility

- Performance rating

- Utilisation and Productivity

- Engagement Score

Determine Roles of Interest

At first glance, and particularly with a large organisation, workforce planning can appear to be an overwhelming task of ‘boiling the ocean’. Determining roles of interest allows you to make educated decisions based on where a planned workforce intervention will generate the biggest return on investment.

Whole Workforce Approach

A defining factor of the fourth industrial revolution is that ‘workforce’ is a loose concept that incorporates not just permanent employees, but temporary employees, contractors, gig workers, consultancies under statements of work, service providers and, increasingly, robots. As such, even an intent to assess an entire workforce will require a considered view on what should be considered in scope. Even at a basic level, an organisation will need to take a decision about whether to include those on long-term abstraction (eg career break, parental leave, long-term sick leave, secondment) or include ‘employees’ such as fixed-term contractors.

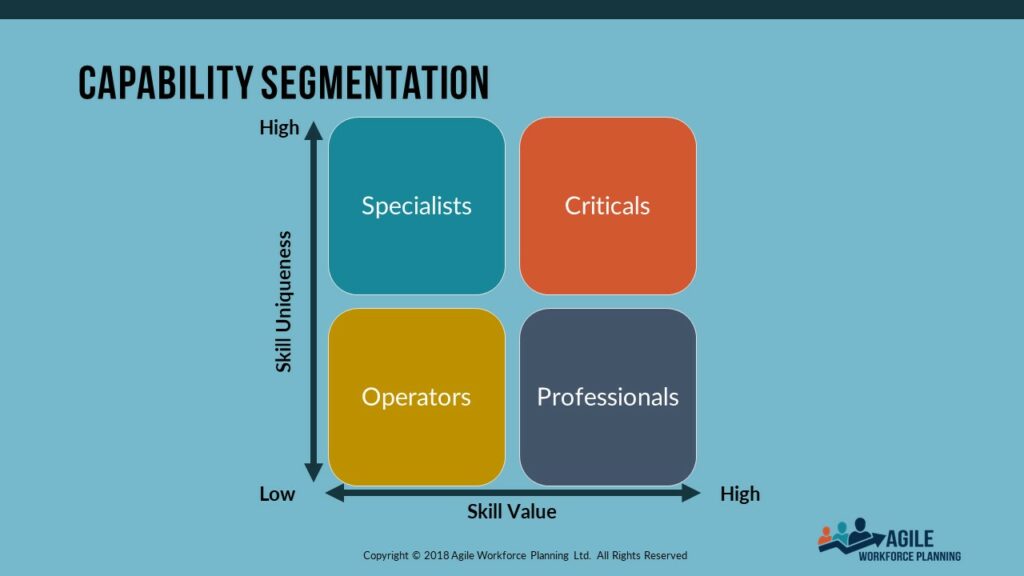

When looking at a whole workforce, I find the most useful approach is to use an adapted version of the HR architecture proposed by Lepak and Snell (1999), which splits the workforce into four quadrants based on:

- the uniqueness of a capability (is it scarce within the industry and wider marketplace), and

- the value of that capability to the organisation, both in terms of low and high, but also shifting from a Gaussian distribution (bell-curve) of performance to a Paretian distribution (power law) relationship where exceptional performance drives exponential value2.

Specialists are a capabilities that are unique and generate a comparatively lower value to the organisation. As these capabilities tend to hinge around very specific processes, they tend to be concentrated around a particular business or industry. The clear characteristic is that this specialism is typically not in demand from organisations in different industries. I tend to break these down into two types:

- Planned Specialists usually go through lengthy and vigorous training to achieve their specialism, accompanied by a high initial outlay on training costs. A classic example of these are metro/underground drivers, who cannot be transferred to other modes of transport (trains & planes)

- Accidental Specialists tend to grow over time and are identifiable by long service within the business or industry and have developed a specialism through experience over time. They tend to be “the only person who knows how to…” and likely to slip inadvertently into the Critical category.

Professionals are the opposite of specialists, common capabilities across industries that add high value and tend to be characterised by professional accreditation, eg project management, digital skills, finance and HR. This capability tends to be the core of the workforce in a knowledge worker setting.

Operators are generalist capabilities that generate a comparatively lower value to the organisation and incorporate manual labour, administrative and entry-level roles that require limited initial training.

Critical Roles

Criticals are those capabilities that are both unique within the industry and create considerable value to an organisation, and share some of the following characteristics:

- They are critical to delivering the business strategy (both in terms of development and execution)

- They provide an organisation’s current comparative advantage

- They will provide an organisation’s future comparative advantage

Some of the best thinking on the characteristics of critical roles came from Becker, Huselid and Beatty (2005 & 2009) in what they called “A Positions”, which were determined as:

- “Those in which top talent significantly enhances the probability of achieving the business strategy.

- Employees are hard to get; top talent is difficult to attract and retain.

- Positions create wealth (by substantially enhancing revenue or reducing costs).

- Mistakes may be very costly, but missed revenue opportunities are a greater potential loss to the firm.

- Selection of the wrong person is expensive in terms of lost training investment and especially lost revenue opportunities.

- Poor performance is immediately detected.

- Strategic positions have major revenue-enhancing or cost reducing impact on the firm.

- Strategic positions have strategic impact on the firm’s customers.

- Substantial performance variability is possible, depending on the incumbent.

- These positions usually comprise less than 15 percent of the firm’s positions.

- Strategic positions are not determined by placement in the firm’s hierarchy.”

By focusing on critical roles, those conducting strategic workforce planning can focus on areas of the workforce where planning can generate the greatest proportions of return on investment (RoI).

1 – There are different national definitions of this, ranging from 30 hours upwards. The alternative is to group together different FTE groups (eg <0.4,0.4-0.8, >0.8)

2 – In Laszlo Bock’s 1995 bestseller Work Rules!, he comments on the bell-cure view of performance being outdated compared to a power law view. The reality is that, though knowledge workers typically perform on a power law (and is therefore the case at Google, where Laszlo was SVP of People), process workers typically still operate on a bell curve.

Adam Gibson is a global leader in Workforce Planning, creator of the Agile Workforce Planning methodology and a popular keynote speaker. He has successfully implemented and transformed workforce planning and people analytics in businesses across both the public and private sector. As a consultant, he advises company executives on how to create a sustainable workforce that increases productivity and reduces cost; he is also the head of CIPD’s workforce planning faculty.